Single Family New Construction, Rehabs & ADU's

Konhoff Company looks for Single Family deals to either rehab-and-rent or rehab-and-sell. Our Single Family Rehab-and-Rent deals maximize returns by taking advantage of current market dynamics available in rapidly appreciating regions. We target homes where we can add value through renovation and provide rental yields of 5-8% during a hold period of 2-3 years. Our select markets on the West Coast are expected to appreciate 5-20% per annum over the next 12-36 months. This strategy aims to maximize returns while mitigating risk by using loan-to-value ratios of less than 60%. Our Single Family Rehab-and-Sell deals target a Return on Investment of 15-20% with a project Timeline of 30-120 days depending on the level of renovation required.

Whether you are just beginning to build your real estate portfolio or are already a seasoned investor, our turn-key investment strategy can offer a vehicle enabling you to capture opportunities currently available.

Whether you are just beginning to build your real estate portfolio or are already a seasoned investor, our turn-key investment strategy can offer a vehicle enabling you to capture opportunities currently available.

Coming soon! Lisa Lane (Contra Costa County, California)

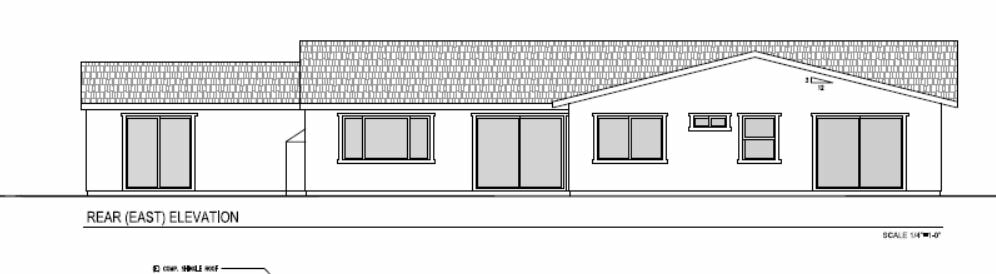

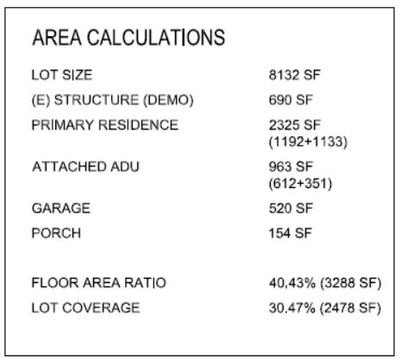

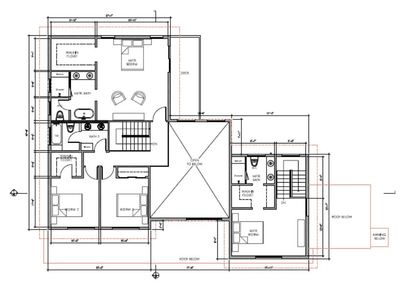

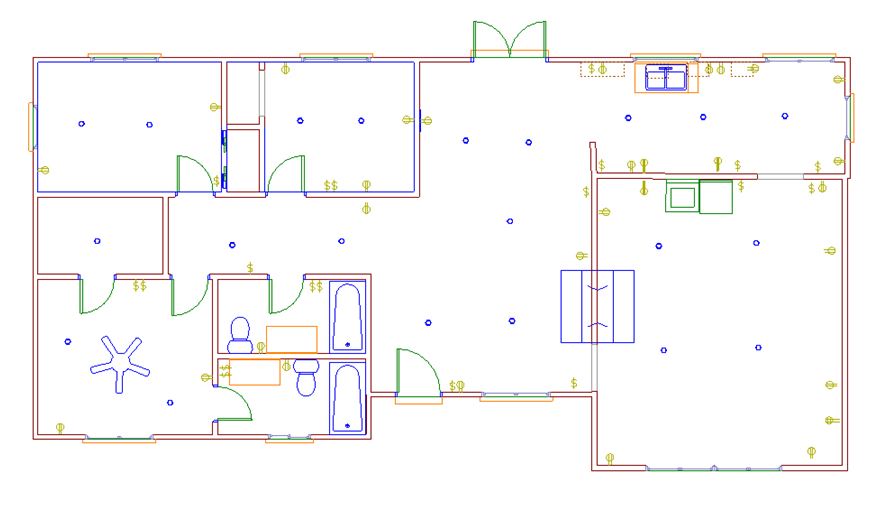

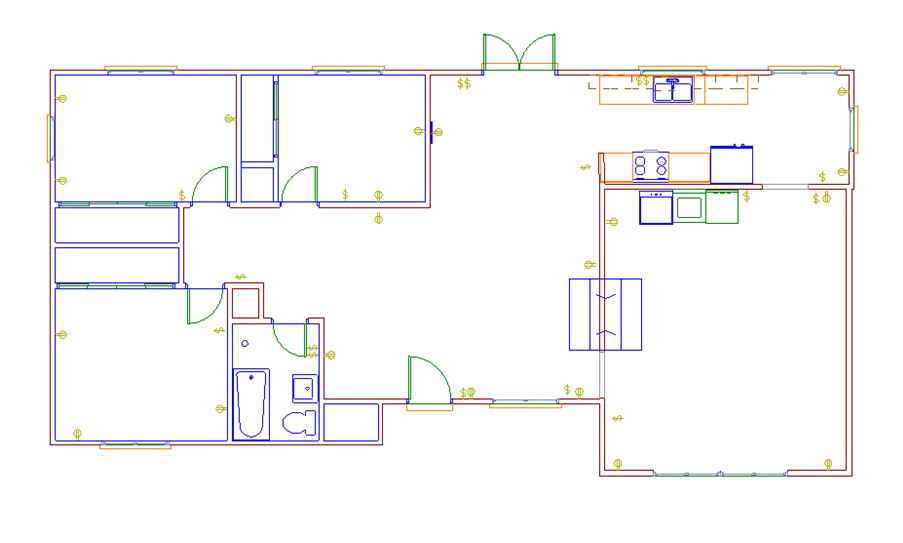

Pleasant Hill, California: New Construction 2018

Pleasant Hill: after remodelOakley Case Study: after remodelPurchased as REO and Rented up immediately as-is with no remodel at 9% yield. Sold 16 months later using rental cash flow to fund 100% of remodel costs.

Trilogy case study: after remodelProperty located in Trilogy Master Planned Seniors 55+ Community. Purchased on Short Sale from bank in November 2014 for $175,000 plus $8,000 in back HOA fees.

|

Pleasant Hill: before RemodelOakley Case Study: before remodelRemodel included new porcelain tile flooring, full kitchen remodel, new paint and landscaping. Property held for 29 months with 30% annualized Return on Invested Capital

Trilogy case study: before remodelProperty flipped in April 2015 for $273,000. Rehab budget of $30,000 included new tile floors and carpeting, quartz kitchen counters and stainless steel appliances, bath remodels, new landscaping, interior & exterior paint.

Annualized cash-on-cash return of 55.6%! |

American Canyon case study: after remodel |

American Canyon case study: before |

|

Property purchased in 2014 for <50% of 2006 peak value.

|

4 Bedroom/2 Bathroom. Full remodel included new Luxury Vinyl Tile Flooring, full kitchen, bath remodels and new landscaping

|

Trilogy case study: after remodel:Home was put under contract within 36 hours of listing.

|

Trilogy case study: before remodel:Remodel included new engineered hardwood, new Milky Way Galaxy Granite Island and counter tops, new appliances, paint, tile work

|

Oakley case study: after remodel:Property sold for $275psf in 1st Quarter of 2014 for annualized ROI of 55%. Home went under contract within 18 hours of listing to a FHA first time home buyer.

|

Oakley case study: before and after videoPurchased from bank as distressed and owner-occupied property in 4Q2013 for $148psf. Rehab budget was $68psf. Project included city-approved plans for a master bedroom and bathroom addition.

|

Antioch case study: after rehab:Home located in Antioch, CA currently valued at $280,000.

Property is currently leased for $1,600 per month. |

Antioch case study: before rehab:Purchased distressed 3Bd/2Ba Antioch, CA property in May, 2013 for $151,000. Rehab cost totaled $25,000. Project cost totaled $176,000.

|

Oakland case study: after rehab:Home located in Oakland, CA sold in 2013 for $350spf.

|

Oakland case study: before rehab:Purchased 3Bd/3Ba distressed Oakland, CA property in 2010 for $107psf. Rehab cost totaled $54psf. Project cost totaled $162psf

|

Antioch case study: after rehab:Home located in Antioch, CA currently valued at 75% Higher than Purchase Price. Property is currently leased for $1,650 per month.

|

Antioch case study: before rehab:Purchased in 2013 at less than 50% of 2007 Home Value. Renovated for $8,500 and added to rental portfolio with 2-4 year rent and hold strategy.

|